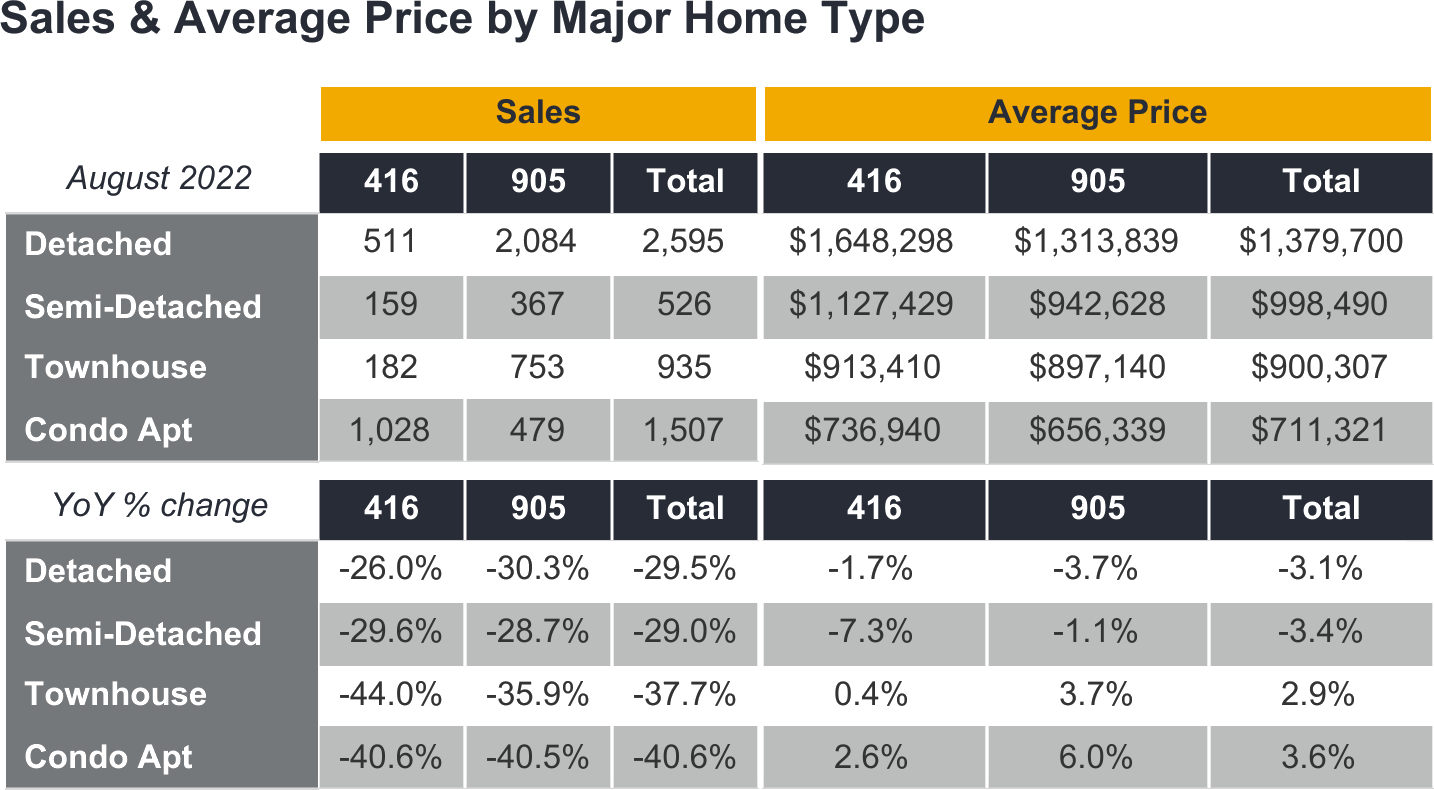

There were 5,627 home sales reported through the Toronto Regional Real Estate Board9s (TRREB) MLS® System in August 2022, representing a year-over-year dip of 34.2 percent 3 a lesser annual rate of decline compared to the previous four months. The August sales result also represented a month-over-month increase compared to July.

Sales represented a higher share of new listings compared to the previous three months. If this trend continues, it could indicate some support for selling prices in the months ahead. On a year-over-year basis, the MLS® Home Price Index (HPI) was up by 8.9 percent and the average selling price for all home types combined was up by 0.9 percent to $1,079,500. The average selling price was also up slightly month-over-month, while the HPI Composite was lower compared to July. Monthly growth in the average price versus a dip in the HPI Composite suggests a greater share of more expensive home types sold in August.

While higher borrowing costs have impacted home purchase decisions, existing homeowners nearing mortgage renewal are also facing higher costs. There is room for the federal government to provide for greater housing affordability for existing homeowners by removing the stress test when existing mortgages are switched to a new lender, allowing for greater competition in the mortgage market. Further, allowing for longer amortization periods on mortgage renewals would assist current homeowners in an inflationary environment where everyday costs have risen dramatically,= said TRREB President Kevin Crigger.

The Office of the Superintendent of Financial Institutions (OSFI) should consider whether the current stress test remains applicable. Is it reasonable to test home buyers at two percentage points above the current elevated rates, or should a more flexible test be applied that follows the interest rate cycle? In addition, OSFI should consider removing the stress test for existing mortgage holders who want to shop for the best possible rate at renewal rather than forcing them to stay with their existing lender to avoid the stress test. This is especially the case when no additional funds are being requested,= said TRREB CEO John DiMichele.

There are other issues beyond borrowing costs impacting housing affordability in the Greater Golden Horseshoe. The ability to bring on more supply is the longer-term challenge. However, we are moving in the right direction on this front. The strong mayor proposal from the province coupled with the recent commitment from Toronto Mayor John Tory to expand ownership and rental housing options are examples of this. TRREB looks forward to hearing additional initiatives from candidates vying for office in the upcoming municipal elections,= said TRREB Chief Market Analyst Jason Mercer.

TRREB is also calling on all levels of government to reassess and clarify policies related to mortgage lending and housing development.

“Many GTA households intend on purchasing a home in the future, but there is uncertainty about where the market is headed. Policymakers could help alleviate some of this uncertainty. As higher borrowing costs impact housing markets, TRREB maintains that the OSFI mortgage stress test should be reviewed in the current environment,” said TRREB CEO John DiMichele.

“With significant increases to lending rates in a short period, there has been a shift in consumer sentiment, not market fundamentals. The federal government has a responsibility to not only maintain confidence in the financial system but to instill confidence in homeowners that they will be able to stay in their homes despite rising mortgage costs. Longer mortgage amortization periods of up to 40 years on renewals and switches should be explored,” said TRREB President Kevin Crigger.

You must be logged in to post a comment.